Essential Treasurer Series 2020

Essential Treasurer Series 2020

The Finance and Treasury Association together with EY, will again present the Essential Treasurer Series for 2020.

The Essential Treasurer Series is the FTA’s annual session to update its members and other interested parties in what is important and topical right now.

The Essential Treasurer Series will take place in Sydney, Brisbane, Perth, and Melbourne and with speakers from Greensill, Bloomberg, and EY discussing:

- Key market information

- Technology – automation, TMS implementation, NPP/Payments

- Benchmark rates – practical to do’s, regulation, options

- Preparing for a zero interest rate environment

- Innovative alternative funding solutions

Register now to ensure your place – networking drinks will follow the program.

Dates and Locations:

The Series will be hosted at EY in each respective city.

Sydney – Tuesday 3rd March 2020

Brisbane – Tuesday 10th March 2020

Perth – Thursday 12th March 2020

Melbourne – Monday 16th March 2020

Time:

Essential Treasurer Series: 2:00pm – 6:00pm (local time)

Networking Drinks: 6:00pm – 7:30pm (local time)

Cost:

FTA Members have access for free to the Essential Treasurer Series.

Non-Members can access the Series for a fee of $50 (inc GST).

Full-Time Students interested in Treasury can access the Series for a fee of $20 (inc GST)

LIQUIDITY INSIGHTS: DEFINING CASH FOR AUSTRALIAN INVESTORS

Defining cash for Australian investors

Head of Asia Pacific Liquidity Fund Management

J.P. Morgan Asset Management

The definition of cash, while ostensibly straightforward – banknotes and coins – becomes increasingly challenging when the demands for higher returns counteracts the obligation to ensure adequate liquidity and the commitment to avoid losses.

As memories of the liquidity stress and market dislocation triggered by the global financial crisis faded, the range of financial instruments deemed acceptable in Australian cash products broadened dramatically. This was also a time when investors grappled with the challenges of outperforming attractive headline retail bank deposit rates.

Unfortunately, defining which instruments are truly cash equivalents is one of the most difficult tasks for modern corporate treasurers.

The Regulatory Dilemma

Globally, cash investors look to regulators and rating agencies to define and clarify suitable cash investment instruments and structures. This is especially true in the United States, European Union, and China, where the size and systemic importance of liquidity and money market funds (MMFs) made this a critical regulatory issue following the 2008 financial crisis.

These rules and regulations vary from prescriptive, listing specific approved and unapproved instruments, to abstract, outlining key sources of investment risk and limits to mitigate them. Regardless of the regulator’s philosophy, the ultimate goals remain the same – to ensure adequate liquidity and minimise the probability of losses. Over the past decade, global regulators have strengthened MMF guidelines. They now demand higher levels of liquidity, impose tighter investment limits and require increased diversification. For both retail and institutional investors, these new rules have raised the standard of MMF investing while significantly reduced the likelihood of funds suffering losses, albeit at the expense of lower potential returns.

In contrast to detailed global standards, Australian regulators have historically demurred the responsibility to define cash or the suitability of various instruments for cash investments. The Federal government’s unlimited bank guarantee during the Global Financial Crisis helped shelter the local financial industry while a long history of self-regulation encouraged investors to create their own definitions of cash and cash equivalents.

However, in 2018, a review of cash investment products by the Australian Prudential Regulation Authority (APRA) raised significant concerns about the level of volatility and risk in these products. Across the industry, the range of instruments and structures defined as cash varied enormously – as did returns. This created confusion for retail and institutional investors. In its subsequent report, APRA highlighted “examples in the industry where cash investment options appear to include exposure to underlying investments that would not generally be considered cash or cash-like in nature”1.

To encourage investment consistency and reduce the volatility of cash investment products, APRA concluded that “cash equivalents represent short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value”1.

Cash means security, liquidity and return

The report signalled a tougher regulatory stance and additional focus on questionable cash investments styles. However, in the absence of detailed regulatory guidelines and exact definition of liquidity and risk, investor due diligence is still required to balance the need to preserving capital, while ensuring suitable levels of liquidity and maximising returns.

Three key steps in this process involve clarifying investment policies, creating well defined investment objectives and implementing cash segmentation.

Firstly, using an investment policy statement forms a solid foundation for cash investment decisions. A well written policy provides clarity, instils discipline and allows the organisation to successfully navigate shifting markets, changing regulations and evolving business needs.

Secondly, by defining short term investment objectives and the strategies for achieving them, an organisation can establish acceptable levels of risk, identify permissible investments and detail relevant constraints.

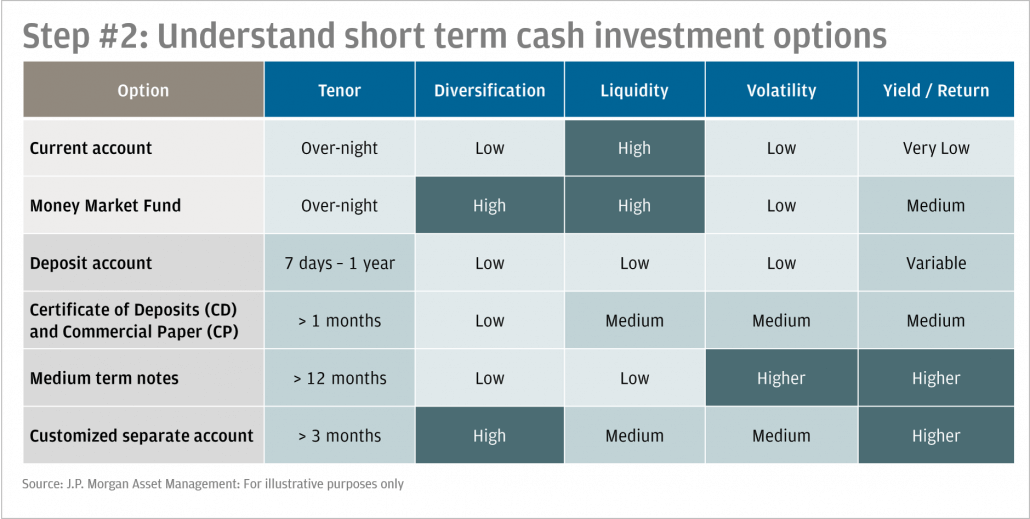

Finally, by putting cash into different segments, the organisation can optimise its investment choices – ensuring it has sufficient liquid cash to meet its daily needs while avoiding the opportunity costs associated with very high levels of liquidity and principal protection by diversifying across different types of cash investment depending on their level of liquidity, volatility, and diversification.

In Conclusion

The new APRA definition of cash has already prompted a significant reorganisation across the Australian cash management industry with several instrument structures being avoided and more conservative investment guidelines introduced. This, combined with more due diligence and understanding of the underlying risks by retail and institutional investors, should help the industry create a safer foundation for future growth.

To read more our liquidity insights, visit www.jpmgloballiquidity.com

Essential Treasurer Series 2019 – Speaker presentations

Essential Treasurer Series 2019 – Speaker presentations

The FTA, together with EY held the Essential Treasurer Series in March 2019 visiting members in Brisbane, Sydney, Perth and Melbourne.

With regulatory and economic disruptions affecting

Download copies of the speaker presentations

Session 1: Commonwealth Bank – Economic Update

Sydney presentation by Stephen Halmarick

Melbourne presentation by Kristina Clifton

Perth presentation by Gareth Aird

Brisbane presentation by Belinda Allen

Session 2: Treasury of the Future

Presentation by Ian Walford – Perth

Presentation by Chris Nelson – Brisbane

Session 3: IBOR by EY and Bloomberg

Presentation by Nick Burrough, Bloomberg

Session 4: Leasing Update

The RBA’s 50/50 Conundrum

The RBA’s 50/50 Conundrum

Head of Asia Pacific Liquidity Fund Management

J.P. Morgan Asset Management

The Reserve Bank of Australia’s (RBA’s) overnight cash rate has been unchanged at a record low of 1.50% for a record 28-months (Exhibit 1A). Throughout 2018, the central bank’s meeting minutes and speeches suggested that rates remained appropriate — implying a broadly neutral policy stance — while hinting that the next rate movement would be higher, albeit with “no strong case for a near- term adjustment in monetary policy”(1) .

For most of 2018, forwards markets agreed with the central bank and were firmly pricing in future RBA rate hikes — but this has abruptly changed (Exhibit 1B) with the market now indicating a 50/50 chance of a rate cut in 2019. This rapid reversal could exert substantial influence on the central banks thinking with significant implications for money market and fixed income investors.

Stuttering growth engines

Historically, Australia’s twin engine economy has been a source of strength, with the combination of commodity exports and domestic demand helping the country avoid recession for a record-breaking 27-years. In the past half-decade, as mining infrastructure investment waned, a booming housing market — with prices jumping by 45% between 2012 and 2017 – replaced it as the key driver of economic growth.

However, the factors that triggered the housing surge — low interest rates, easy bank financing, limited supply and strong foreign demand have recently faded due to a combination of new macro prudential measures, higher commercial bank mortgage rates and tighter restrictions on foreign buyers. House prices (Exhibit 2A), building permits and new home sales have all fallen sharply, with negative repercussions for retail sales and consumer confidence.

Meanwhile, the well-publicized slowdown in Chinese economic growth and rising global trade tensions have raised the specter of lower demand for key Australian commodity exports including coal, gas and iron ore.

Consequences and conundrums

Throughout 2018, solid business sentiment, an improvement in capital expenditure intentions and a tight labor market — with strong hiring momentum and an up-tick in

The path of least resistance

Economic growth will likely slow in 2019, albeit from a previously robust level. However, fears of a property price crash are likely overdone: Low unemployment and low-interest rates suggest mortgage payments remain affordable and most homeowners still enjoy positive equity. Little mortgage borrowing was completed at the peak which was perceived by many as unsustainable.

Finally, even if the economy slowed faster than expected, the RBA has capacity to cut base rates if necessary and the government’s improved fiscal position has given it the ability to cut taxes or boost spending if required.

Given this backdrop, the RBA is likely to strike a more neutral tone in meeting minutes and revise down its 2019 GDP forecast while keeping base rates unchanged for the foreseeable future — further extending its record-breaking period of inertia.

For cash investors, this suggests that money market yield curves could flatten further, although the recent tight liquidity conditions represent an excellent opportunity to extend duration and lock in attractive longer tenor yields.

To read more our liquidity insights, visit www.jpmgloballiquidity.com.

(1) Reserve Bank of Australia’s December monetary policy meeting minutes as at 18th Dec 2018

(2) Source: Reserve Bank of Australia Statement On Monetary Policy, 9th Nov 2018

2019 Treasury Fraud & Controls Global Survey

2019 Treasury Fraud & Controls Global Survey

This annual survey seeks to evaluate the current and projected impact of fraud on the finance and treasury environment. Practitioners from all industries are polled on their experiences with fraud and on the range of controls, safeguards, and security practices employed to protect their financial assets and information.

Data related to bank account management and reconciliation practices is also gathered for a more comprehensive view of how various treasury operations impact security. This data is compiled annually and used to educate the industry as to how the fraud landscape is evolving, and how practitioners can better protect themselves and their organizations against attacks.

In this survey, treasury and finance professionals were asked questions on topics such as fraud experience, cyber risk management, bank account management and more.

Webinar: Insights to Working Capital Optimisation

Insights to Working Capital Webinar

FTA Conference 2018 speaker presentations

The following presentations were made at the recent FTA Conference on 14 – 16 November 2018.

Day 1: Thursday 15 November 2018

Keynote Speaker: Penelope Twemlow, CEO, Energy Skills Queensland

“Rethinking the leadership role of the Treasury Function – opportunities for the future and beyond”

| 11.50 am- 1 pm | Stream 1: The Strategic Treasurer | Stream 2: Global Economic Environment |

| Strategic-treasurer-PwC | Global-economic-environment-CBA | |

| Strategic-treasurer-Lendlease | Global-economic-environment-NSW-TCorp | |

| Strategic-treasurer-Caltex (002) | ||

| 2.00 – 3.30 pm | Stream 1: Different Types of Treasury Approaches | Stream 2: The Capital Stack |

| Different-types-of-treasury-approaches-Metcash | The-capital-stack-AMP | |

| Different-types-of-treasury-approaches-CPB | The-capital-stack-CBA | |

| The-capital-stack-FitchRatings | ||

| 4.00 – 5.30pm | Stream 1: Cash Management | Stream 2: Diversity in Treasury – Leading the Way |

| Cash-management-Chelsea-McGregor | ||

| Cash-management-Pepper-Financial |

Day 2: Friday 16 November 2018

| 9.10 – 10.00 am | Stream 1: Treasury Technology | Stream 2: Risk Management – High-speed panel discussion on managing risk |

| Risk-management-panel-discussion | ||

| 10.00 – 10.55 am | Stream 1: Fintech, Big Data, Crypto-Technologies | Stream 2: Accounting AASB16 |

| Crypto-tech-TravelByBit | Accounting-AASB16-Deloitte | |

| Disruption-SP-Global | Accounting-AASB16-SP-Global | |

| Blockchain-CBA | Accounting-AASB16-Metcash | |

| 11.20 am- 12.35pm | Stream 1: Back To the Future – Hedging in 2030 | Stream 2: Networking – Why? |

| Networking-why |

Special Interest Group (SIG) for Bank Treasurers 11.00am – 1.15pm

This was an invite-only event led by Steven Cunico FFTP, Partner, Deloitte & FTA Board Member.

Spotlight on cross-border payment challenges

SPOTLIGHT ON CROSS-BORDER PAYMENT CHALLENGES

SPEED:

“Critical business requires faster payment execution”

TRANSPARENCY:

“Many times we don’t have visibility on the fees lifted along the way”

TRACKING:

“I’m not able to tell when the money hits the beneficiary’s bank account”

REMITTANCE INFORMATION:

“We miss information regarding the invoice and the payer for timely reconciliation”

EACT, the European Association of Corporate Treasurers, representing 23 national associations of corporate treasurers has always been at the forefront of innovation and new regulations. This EACT Briefing focusing on cross-border payments, will help treasurers in their day-to-day activities. As the world becomes more and more international so is the activity of the treasurer. This edition focusses on gpi, the new SWIFT Global Payment Innovation, which will significantly improve international payment processes and address many of the issues treasurers are facing today.