Exchange September 2020

Hi Members,

Hope everyone is doing well in what no doubt has been a busy last couple of months in the FY changeover period. Not to mention the extraordinary time we are in!

At FTA our focus is on continuing to deliver CPD and other services to you digitally during this lockdown/WFH time. Our calendar is full as you will see from webinars and our other programs such as Treasury Management and Fundamentals. Please keep looking out for these, continuing professional development is something that is never not needed.

The big thing right now though is the work on Conference. Hopefully, you’re all seeing our updates, we’re extremely proud of, and excited by, the program that has now been developed. When we have speakers of the caliber of Kevin Rudd, Stephen Koukoulos, and Matt Gertken, and case studies from businesses such as Coles and Oil Search, you know its going to be great.

Please jump on board, we can’t wait to see everyone there – the interaction and networking is also fantastic on our platform.

Take care

Ben Leaver

Getting to know the Young Leaders Committee

It has been an honour to be the first female Chair of the Young Leaders Committee for the FTA. The opportunity to collaborate with and work alongside such a high caliber of young professionals in the Treasury industry has been both rewarding and fulfilling.

What I enjoy about being part of this Committee is the immense talent, diversity of skills, and strong work ethic each member shares, tantamount to their professional careers and development.

Our committee has worked successfully towards our FY20 objectives of educating our local students and empowering young professionals in our industry to aspire to succeed in their career – which is what makes me truly proud of being part of the FTA community.

Therefore, I would like to extend my special thanks to Kirsty, Toby, Andrew, and Piero for all your tremendous efforts and commitment over the past year. I have been thrilled to participate in and observe the development of this committee, as we aspire towards becoming future leaders in the Corporate Treasury and Finance space in Australia.

When I first began my journey in the FTA community, I was extremely lucky to be part of the mentorship program as a mentee. Notwithstanding my previous experiences of mentorship programs earlier in my career in Banking, I was able to really distinguish and relate to the philosophy of mentorship. The FTA matched me with an influential Corporate Treasurer as my mentor. I recall feeling immediately impressed not just by her successful career, but most importantly her passion in fulfilling her role as a devoted mother and having such a warm bubbly personality! I was inspired instantly and understood that was the same magnitude of energy and presence I would like to demonstrate as a future mentor.

Over the past year attending educational FTA seminars, networking events, webinars, and conferences it has been such a rewarding experience since I joined the Association. These opportunities in meeting incredible professionals in the corporate industry have created lasting impressions as I continue to support and advocate the Treasury Profession.

Despite the immediate global challenges this year, the Young Leaders Committee has committed to keeping us at the forefront of this dramatically evolving environment. With a variety of concerning the industry, risks have never been so prevalent that the reliance on sound Finance and Treasury professionals has never been so demanding.

Our aim is to continue to empower young professionals, aspiring students as well as the rest of our Treasury community to continue to strive for excellence in their current and future careers, as well as their corporate service – We, will continue to promote our committee in FY21 through the communication of our innovative ideas, collaboration with our extensive FTA network, and ultimately demonstration of our financial stewardship through our industry experience.

I look forward to seeing the YLC continue to develop and contribute exciting outcomes to the FTA community in the coming Financial Year.

Mary-Jane Carcasona

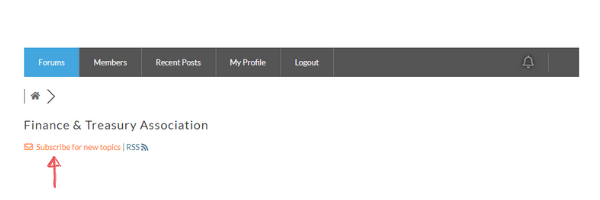

Have you seen and explored the new Member Portal? Behind the scenes, we have been working hard to bring you a more streamlined and Member friendly portal. Included in the recent upgrades has been the inclusion of a Member Forum for the Australian Treasury Community.

Ask questions, or create a new discussion thread. The Member Forum is the place to engage with the Australian Treasury Community.

How to Subscribe –

You can choose to receive an update each time a comment is made in all Forum Threads by clicking ‘Subscribe for new topics’ found on the Forum Home Page, under Finance & Treasury Associaiton (as above); alternatively you can select which Threads you only wish to receive updates from by clicking on your chosen Thread (eg General Treasury) and clicking on ‘Subscribe for new topics’.

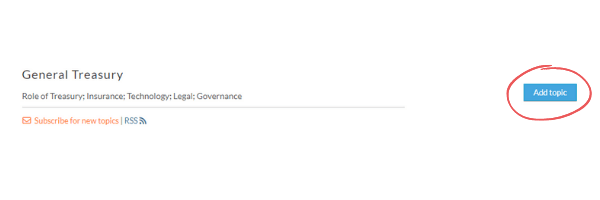

If you would like to create a new Topic, you can do this by selecting ‘Add topic’ in the top right corner of your chosen Thread.

We encourage you to sign in and join the conversation here.

Webinar: Bank Treasury – 23rd September

University of Western Australia Event – 24th September

Webinar: Supply Chain Finance: An Australian Perspective – 30th September

Treasury Management Course – 15th, 22nd, & 29th October

Fundamentals of Treasury Course – 27th October

National FTA Conference – 10th, 11th, & 13th November

In November the inaugural virtual FTA Conference 2020 is taking place. I have been involved in a number of FTA conferences over the years and it has been inspiring to work on this initiative, helping the FTA executives and the conference committee pull together an event creating an opportunity to enjoy all the benefits of attending a conference as we have shared in the past, this time virtually. I am excited we will have the benefit of a virtual conference which will not be a series of webinars, but an opportunity to hear presentations, interact with panels (many of who will be on a live stage), have one on one sessions with our exhibitors, and our peers.

Even though we have been put in a position to run the conference in this way, due to the COVID-19 pandemic, the outcome is an opportunity to have an event where we can reach an even greater audience than has been possible in the past. Yes, the networking will be different, but it will be there, it will be an opportunity to share the stories and experiences that enrich our attendance. The conference committee has pulled together a technical program that is packed full of content and insights from your treasury peers (over 20 corporate treasurers supported 22 experienced treasury professionals) by sharing their experiences while developing a view on what the future of treasury may look like. This is complemented by our inspirational/experienced speakers focusing on economics, global relations, the outcome of the US elections and our future. Finally, I must, in advance, thank our sponsors and exhibitors, they are making a contribution to the content, offering virtual experiences, and providing support in a number of other ways.

Book your place today – www.ftaconference.com.au

Regards,

Paul Travers

Do you have an upcoming role you need to advertise? We’re pleased to offer companies the chance to promote their new listings on the FTA jobs board. Find out more by contacting us at membership@financetreasury.com.au

We have recently changed our mailing address and contact phone number. Please ensure you have also updated your records to ensure your communications to the Association are received in a timely manner.

Our new mailing address:

PO Box 21003

Little Lonsdale Street

Melbourne VIC 8011

Australia

Our new phone number:

+61 (03) 9132 5240